Economic Scan - Prince Edward Island: 2024

Demographics

Highlights

In 2023, 174,000 people lived in Prince Edward Island, an increase of 3.9% from 2022 to 2023. Prince Edward Island represents 0.4% of Canada's total population.

Average age of the non-Indigenous population in Prince Edward Island is 42.8 versus 34.8 in the Indigenous population (Census 2021).

- The proportion of seniors aged 65+ is projected to increase from 21% in 2023 to 24.2% in 2033.

- In 2023, individuals aged 55 and over accounted for 40.4% of the working-age population. By 2033, that proportion could reach 42.2%.

- The proportion of youths (15-24 years) is projected to slip from 15% in 2023 to 14.5% in 2033.

- The unemployment rate for youths surged during the pandemic and took the longest to recuperate among the major age categories. The youths age group saw an upward trending unemployment rate during the latter part of 2022, and currently remains on par with what it was in 2019, prior to the pandemic.

The Indigenous population comprises 2.2% of the Prince Edward Island population (2021 Census) and remains under-represented in the Island’s labour market. There are 1,730 Indigenous people in the labour force, and 1,495 of which are employed. The unemployment rate is notably higher amongst Indigenous people (13.9%) compared to the non-indigenous working-age population (10.3%).

In Prince Edward Island, approximately 96% of the population identified English as their first official language (2021 Census) or the language spoken most often at home, while 3% of the population spoke French most often at home. Just under 1% identified a first language that was neither English nor French. (2021 Census).

Recent immigrants (those arriving between 2016 and 2021) accounted for 41% of the Island's immigrant population in 2021. The pace of new arrivals has increased significantly in recent years, particularly as the province has relied on immigration to fill labour market gaps.

According to 2022 data on disability in Canada, the prevalence of disability (i.e. the disability rate) in P.E.I. was 31.8%, or 5.8 percentage points higher than at the time of the 2017 Canadian Survey on Disability. The disability rate rises with an ageing population base, which largely explains the increase in the province. P.E.I. experienced the lowest growth in disability rates among its Atlantic counterparts and compares to a 4.7 percentage point increase nationally.

Labour Market Conditions

In 2023...

Employment grew considerably (5.7%)

Unemployment increased (1.4%)

Participation Rate rose (65.5% to 66.4%)

Employment Rate increased (60.5% to 61.5%)

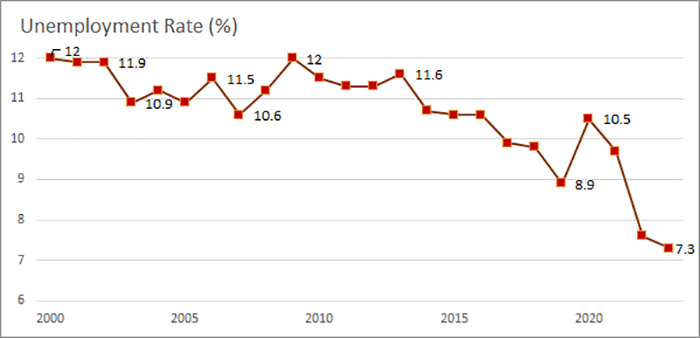

Province's Unemployment Rate

Show data table: Unemployment Rate

| Unemployment Rate (%) | |

|---|---|

| 2000 | 12.0 |

| 2001 | 11.9 |

| 2002 | 11.9 |

| 2003 | 10.9 |

| 2004 | 11.2 |

| 2005 | 10.9 |

| 2006 | 11.5 |

| 2007 | 10.6 |

| 2008 | 11.2 |

| 2009 | 12.0 |

| 2010 | 11.5 |

| 2011 | 11.3 |

| 2012 | 11.3 |

| 2013 | 11.6 |

| 2014 | 10.7 |

| 2015 | 10.6 |

| 2016 | 10.6 |

| 2017 | 9.9 |

| 2018 | 9.8 |

| 2019 | 8.9 |

| 2020 | 10.5 |

| 2021 | 9.7 |

| 2022 | 7.6 |

| 2023 | 7.3 |

- The Island’s labour force and employment bases reached record levels in 2023 and both well surpassed their pre-pandemic 2019 levels. At 5.7%, the Island led the country in employment growth, having outpaced the national average by 3.3 percentage points.

- The number of persons unemployed on the Island increased by 1.3% in 2023. The Island’s unemployment rate fell to its lowest annual rate on record, at 7.3% in 2022 which compares to a relative pre-pandemic norm of about 9.5%. One factor owing to the considerable reduction in the province’s unemployment rate is that there still remains a relatively high number of people not participating in the labour force. There were 48,600 persons not attached to the labour market in PEI in 2023 which compares to 43,000 in 2019, prior to the pandemic. The pandemic triggered an immediate surge in the number of people that left the labour market, but since then, many remained unattached to the labour market (i.e. not available or looking for work). The majority of those that left, and remain out of the labour force, were older workers (55+).

Economic Conditions

Prince Edward Island's Economic Drivers in 2023

Population growth (domestic demand)

Housing

Exports

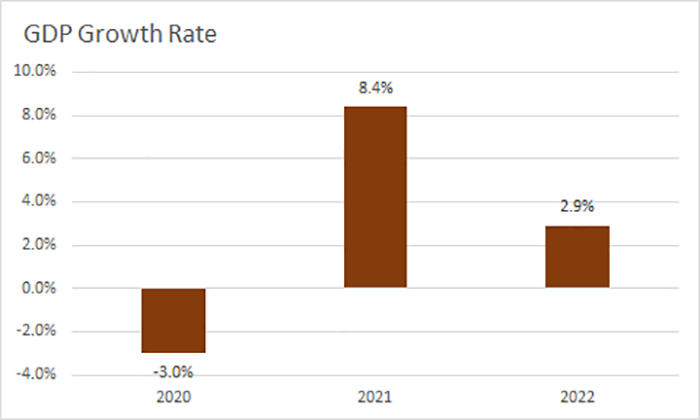

Show data table: GDP Growth Rate

| GDP growth rate (%) | |

|---|---|

| 2020 | -3.0% |

| 2021 | 8.4% |

| 2022 | 2.9% |

- In 2023, the Island’s population base rose by an annual record growth rate of 3.9%, driven by international immigration/non-permanent residents and to a lessor degree, net positive inter-provincial migration. The Island ranked second in population growth in 2023 (behind Alberta). Though still a key economic driver for 2024, its impact will be relatively less impactful relative to prior years as the P.E.I. government recently announced that it was introducing measures to slow down its population growth for 2024 with the aim of alleviating some provincial pressures

- The province recently released its 5-year housing strategy that prioritizes growing the housing supply in the province (i.e. growing housings strarts to new levels and achieving and maintaining a healthy market vacancy rate of 2 – 4%); providing more options for low- and medium-income earners (increasing affordable rental housing by new builds and acquisitions); and supporting vulnerable persons (addressing homelessness and increasing the availability of supportive housing).

- International demand for Island-based goods surged in 2023. The value of exports totalled $2.4 billion in 2023 (+13.5%) which is a record-level. By value, demand was strongest for processed potato products and tablestock potatoes; followed by frozen seafood; and durable goods associated with pharmaceutical and aerospace-related manufacturing.

- With respect to PEI’s economic prospects moving forward, the P.E.I. Finance projects that the Island economy will expand by about 4% in 2024, following an estimated 2.7% performance in 2023. The Island economy in 2024 will continue to benefit from recognizable drivers such as population and employment growth, construction activity, and a robust tourism sector.

Risks to the Prince Edward Island Economy in 2024

- Moderating the Island’s economic growth potential includes elevated interest rates - due to restrictive monetary policy - and sustained high prices following a period of strong inflation. Both of these factors will continue to limit growth in domestic spending and investment, at least until these trends ease and stabilize. There are expectations that the Bank of Canada will start to lower interest rates in 2024, however it is unclear as to the degree and longevity of which.

- Current indications suggest a more optimistic, yet moderate global outlook in 2024, due in large-part to better-than-anticipated economic performances in the U.S. and other emerging and developing economies. Sustained geopolitical unrest, the cost of living crisis; reduced fiscal spending and support; and the possibility, degree and longevity of a global recession are factors limiting growth prospects

Provincial Issues

- Labour shortage remains a chronic issue across the broad spectrum of skilled and unskilled occupations in the province – from health care professionals and construction workers to lower skilled fish plant workers and housekeepers. On February 20, 2024, the province of PEI announced a new recruitment and retention strategy aimed at accelerating the hiring of skilled construction workers to fill workforce shortages in the industry.

- The province continues to contend with considerable health care pressures due to the lack of staff and overcapacity issues, resulting in closures to emergency room services, clinics, etc. Growing health care needs driven by the aging population and years of strong immigration is expected to keep pressure on the Island’s already at/over-capacity health care system. In their February 29 Provincial Budget, the province introduced initiatives to help alleviate health care shortages such as targeted recruitment incentives, and training and upskilling opportunities for health care professionals (such as upskilling LPNs to become RNs, for example).

- Lack of affordable housing continues to be a major issue in the province perpetuated by strong growth in immigration. Construction of single dwellings in the province peaked in 2021, but has since slowed in part due to rising mortgage rates and inflationary pressures, which has made owning a home less affordable. By contrast, construction of multi-unit complexes increased due to the strong market demand for rentals. This has put some downward pressure on rental vacancies, but the new builds have contributed to higher rental costs.

Industry Trends

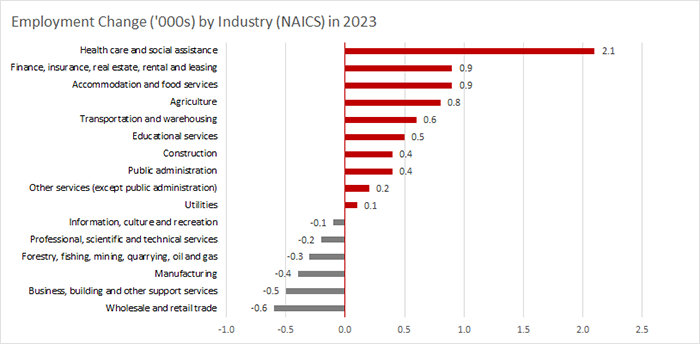

Show data table

| Industry (NAICS) | Employment Change ('000s) |

|---|---|

| Health care and social assistance | 2.1 |

| Accommodation and food services | 0.9 |

| Finance, insurance, real estate, rental... | 0.9 |

| Agriculture | 0.8 |

| Transportation and warehousing | 0.6 |

| Educational services | 0.5 |

| Construction | 0.4 |

| Public administration | 0.4 |

| Other services (except public administration) | 0.2 |

| Utilities | 0.1 |

| Information, culture and recreation | -0.1 |

| Professional, scientific and technical services | -0.2 |

| Forestry, fishing, mining, quarrying, oil and gas | -0.3 |

| Manufacturing | -0.4 |

| Business, building and other support services | -0.5 |

| Wholesale and retail trade | -0.6 |

- The construction industry has proved resilient throughout the pandemic and continues to be a key economic driver in the provincial economy. The industry continues to be supported by strong residential and non-residential construction activity. The level of employment in the industry reached a record high in the province in 2023. All indications point toward robust construction activity in 2024 with expectations that interest rates will begin to fall coupled with continued housing development to support population growth. This is backed by the province’s 5-year housing strategy, introduced above, with an increased capital budget for 2024-25. Construction repair and renovation activity will continue to be a strong point as well. A limiting factor, however, continues to be labour shortages and unfilled vacancies across the industry.

- The Island’s tourism sector made considerable headway in its recovery from the pandemic and the 2023 season experienced respectable growth. Tourism traffic via air and bridge grew considerably in 2023, following surging traffic flow in 2022. Although there were slightly fewer overnight stays in 2023 compared to the previous year, it is worth noting that overnight stays surged by 73% in 2022 resulting in a strong (recovery) season for the sector. The accommodations and food industry experienced employment growth of over 16% in 2023 (with cumulative growth of 30% since 2021, which completely recovered the 29% drop in employment during the 2020 pandemic year). A limiting factor for the sector however, will be the ability for employers to find enough workers in light of chronically tight labour market conditions since the pandemic. Higher prices and elevated interest rates may also cut into disposable incomes and travel plans.

- Manufacturing activity has been robust throughout 2023, supported by surging shipments of non-durable and durable products – both of which were at all-time highs, by value. Furthermore, this builds on record-level shipments experienced in 2022. Looking ahead to 2024, current indications suggest manufacturing and export activity should continue to support economic growth in the province, supported by better-than expected global recovery – particularly in the U.S., our largest trading partner.

Download the PDF version (552 KB) of this content.

- Date modified: